| Description |

| Description |

There are some requirements with regards conducting import/export of processed wood and non-timber forest product; these requirements include:

· Apply for export/import quota

· Apply for export/import license

· Apply for transportation permit

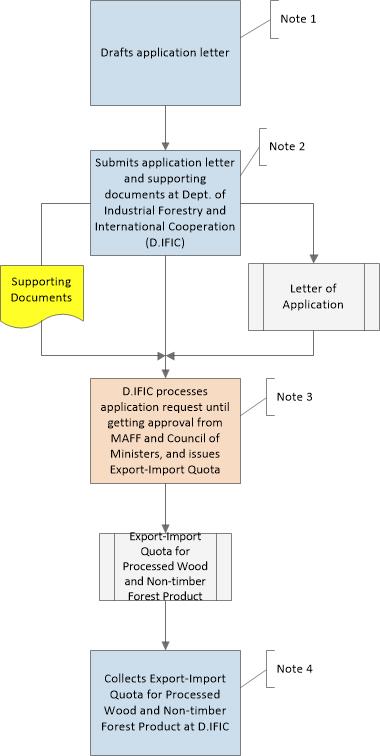

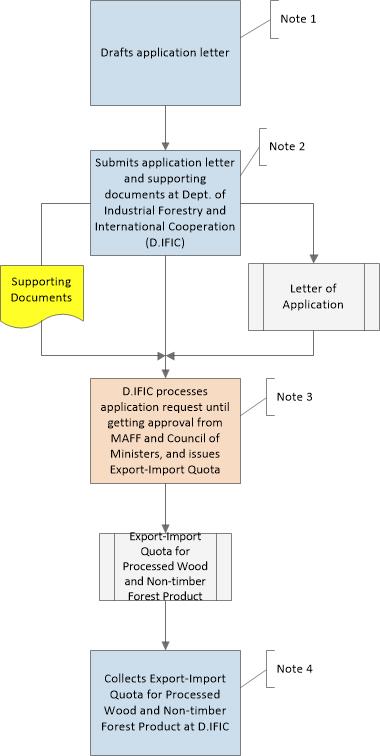

This document shows the application process for Export-Import Quota for Processed Wood and Non-timber Forest Product. |

| Place for submitting application |

Applicant may go directly to the Dept. of Industrial Forestry and International Cooperation (D.IFIC) of the Forestry Administration, which is the MAFF’s technical agency in charge of issuing all types of CLPs above. D.IFIC has administration office inside the department’s building.

Applicant would go directly to this administration office to inquire about the service, get sample application forms, submit, pay fee, and collects the requested all types of authorization documents. There may be chances that applicant is advised to deal directly with the technical office, which is Commerce and Forestry Certificate Office of D.IFIC.

Address of the Dept. of Industrial Forestry and International Cooperation:

Forestry Administration

Address: #40, Norodom Blvd., Phnom Penh, Cambodia.

Person of Contact Name: H.E. Ham Saravuth (Chief of Commerce and Forestry Certificate Office)

Person of Contact Tel: (855) 12 826842

Website: www.forestry.gov.kh/ |

Notes

| Note 1 |

Applicant can get sample application form at the Administration Office of D.IFIC. It is not a form actually; rather a Letter of Application so applicant may draft it by himself but should consult with the Administration Office on the format and what is to be included in the letter. |

| Note 2 |

Applicant can assign a representative to submit application and go through the required application process on his behalf. In this case, Power Attorney or authorization letter is also needed to include into the application.

Supporting Documents for export application done by ELC concessionaire include:

- Land clearing permit

- Permit for opening of factory for wood processing

- Reports on the estimation of the forestry product stock or LP/CP document

Supporting Documents for export application done by non-ELC concessionaire include:

- Business Registration Certification

- Tax Registration Certificate

- Permit for opening of factory for wood processing

- Documents that proves the concerned forestry products are legal (e.g., purchasing document)

Supporting Documents for import application:

- Business Registration Certification

- Tax Registration Certificate

- Company's memorandum and articles of association

- CO certificate

- List of all the products

- Buy & Sale documents or contract

If applicant submits copied version of any supporting documents that is relevant to applicant’s identification including Business Registration Certificate and Tax Registration Certificate, it is normal requirement that these copied documents be certified by competent authorities first. |

| Note 3 |

Internal process starts from technical office inside the department and go through several consideration and approval process by relevant officers/offices in institutional hierarchy order.

During this internal process, applicant may be asked or advised (practically by phone call) by officer to provide further information and/or documents for the completeness of application.

The process involves FA sending approval request from MAFF. After giving its approval consideration, MAFF will also draft a letter requesting approval from Council of Ministers. Only after approval letter is issued from the Council of Minister that the application is considered approved and FA will continues the application process until issuance of import/export quota and advise applicant to come collecting it. |

| Note 4 |

The process of requesting import/export quota does not require any fee. The Export/Import Quota for Processed Wood and Non-timber Forest Product is valid for 1 year and has details of product specification and amount. Applicant may bring identification documents of himself and application filing receipt/payment receipt when he comes to collects the certificate. |

|