|

Description

|

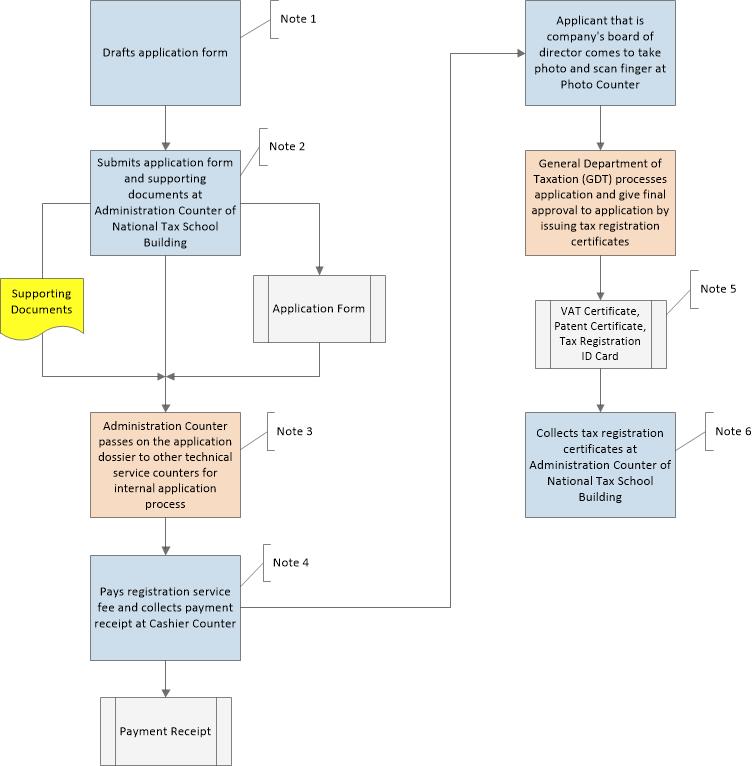

Businesses must register with tax authorities within 15 days after receiving MoC’s business registration certificate.

After successfully following this application process, business will receive a set of the following certificates:

· VAT Certificate

· Patent Tax Certificate

· Tax Registration Identification Card

|

|

Place for submitting application

| Applicant may go to National Tax School Building to process his application request. The building, though part of the General Department of Taxation, is located in different location to the Tax office headquarters. There are various counters staffed with technical staffs to process an applicant’s application. Effectively, each application is passed on from one counter to another counter during the application process and applicant may follow the process. General Department of Taxation Address: #522-524, Corner Russian Federation & Mao Tsetong Blvd. Toek Laak I, Tuol Kork, Phnom Penh, Cambodia. Tel: (855) 23 886 708 E-mail: gdt@tax.gov.kh Website: www.tax.gov.kh/ National Tax School BuildingAddress: #41-43, St. 112, Sangkat Phsar Depo 3, Khan Tuol Kok, Phnom Penh,, Cambodia.Tel: (855) 23 884481 |