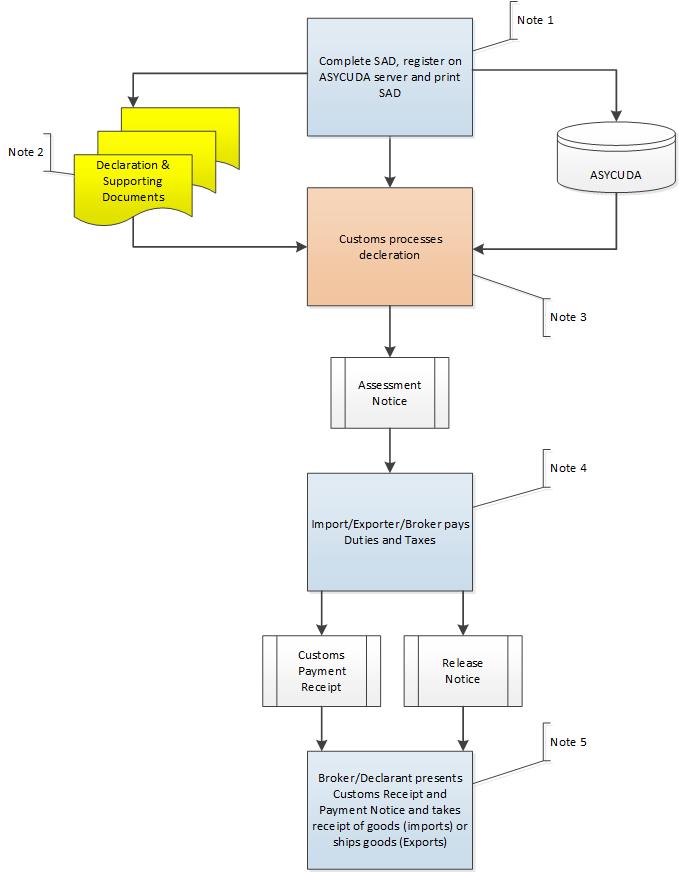

| Customs processing shall first include a ‘face-vet’ of the deceleration hard-copy to ensure the SAD is properly filled, clear and legible and signed by the Customs Broker/Declarant, and that all required documents are attached. After acceptance of the SAD, the receiving officers shall request ASYCUDA ‘assessment’ of the SAD and the SAD will be assigned to one of 4 lanes according to pre-determined risk management criteria. The 4 lanes are colour coded as follows: - RED Lane: The SAD must be scrutinized (checked against the submitted documents) and the goods are subject to physical inspection before re-routing the SAD to GREEN lane.

- YELLOW Lane: The SAD must be scrutinized (checked against the submitted documents) before re-routing to GREEN lane.

- GREEN Lane: The SAD is automatically assessed and an assessment notice issued. The may be subject to post-clearance audit (PCA).

- BLUE Lane: The SAD is provided the same treatment as for GREEN Lane and with specific recommendation to conduct a post-clearance audit.

When the SAD is assessed by ASYCUDA, the system will inform the amount of duties, taxes and fees to be paid through issue of an assessment notice. Query Desk If there are some errors in data entry or irregularities found during physical examinations, SAD will be routed to the Customs Query Desk. Customs Broker/Declarant will be notified that the SAD status has changed to “query” and the reasons for the query. Upon receiving the notification, Customs Broker/Declarant shall go to the Customs Query Desk. If any amendments to SAD are required, Customs Officer in charge of Query Desk will discuss with Broker/Declarant. If agreement is not reached, the customs officer will prepare a report or record to GDCE for further action. When the above action is fulfilled and agreement is reached, customs officer shall sign on SAD and update the inspection act based on the results of inspection and settlement at query desk or upon the decision of GDCE. Then SAD will be re-routed to GREEN. |